We Bought a Minivan (With Cash!)

Last week we said goodbye to Trish and hello to Sophia Grace (aptly named because it's soo good!). Purchasing a vehicle can be a very stressful situation, and it's amazing how different this experience was for us compared to when we bought Trish four years ago. We are a heck of lot more mature now and really took our time trying to find a good deal.

We've wanted a minivan for more than a year (since we rented one when we road-tripped to Charleston), so the purchase was a long time in the making. I think that is one of the biggest keys. Patience.

A couple nights before we made the offer, we listened to Dave Ramsey's FPU episode on negotiating. His lesson offers a number tactics for negotiating big purchases, and it was a great motivational message that gave us the firepower to make the deal happen. Not all of them applied to our situation, but we noted the ones that we wanted to include in our negotiating strategy.

Negotiating Strategy

- Don't speak, just listen: I tried to let the sales guy do most of the talking. This gave me time to really think about what I wanted to say and created some awkward moments that made him a little uncomfortable.

- Research: I knew exactly what our Jeep trade-in was worth and what the minivan was worth (not just what they were asking). I used Kelley Blue Book for this. I also knew what similar Jeeps in the area were priced at other dealerships, and that this particular minivan had been sitting on their lot for months, and I had seen the price drop over time from $10,995 to $7,995.

- Cash: I went to the bank before heading to the dealership and took out $1,200 cash, not wanting to spend a penny more.

- Prayer: We spent time with God praying for the whole process. Consulting our heavenly Father is always a great starting point for big decisions in our lives.

- Walkaway power: If the deal wasn't going to happen for $1,200, I was going home, where Kelsey and Rooney were waiting for me. They wanted to come with, but the timing of feeding just didn't work out. It also made walking away easier, knowing that I would have to go home to discuss with Kelsey anything above our offer.

The Negotiation

After I test-drove the van to make sure there weren't any obvious red flags with how it performed, I kept looking over the van to make sure I wasn't missing anything on the inside or outside.

The salesman and I discussed the value of the Jeep. I wanted to discuss this before asking about negotiating the price of the van, because I felt that if I could get what I wanted out of the Jeep, I wouldn't have to ask him to lower the price of the van (which had already been deeply discounted). The salesman told me that they us NADA for valuing trade-ins and that it was more accurate for the Midwest as Kelley Blue Book is based out of California.

Here is a recap of our conversation:

Salesman: The NADA value of your Jeep is probably around $6,200.

Me: I know you'll be able to list this Jeep for at least $10,000, as that's what I've seen online. I also know the minivan has been sitting on your lot for months. If I give you the Jeep and $1,000 cash, do we have a deal?

Salesman: (thinking) I'll admit I only have $100 markup on the van and we're sick of paying interest on the payments. But we are still about $500 off from a deal.

Me: Well, I have $1,200 cash in my pocket, I'll give you that and the Jeep. How does that sound?

Salesman: OK, if I can get my boss to OK that, do we have a deal?

Me: Yep.

Saleman: (on the phone for a few minutes) OK, you have yourself a minivan!

I think the biggest takeaway from the experience was that you must believe in your strategy and hold your ground. You must leave your emotions at home and be comfortable walking away if the negotiation goes beyond the amount you were prepared to spend.

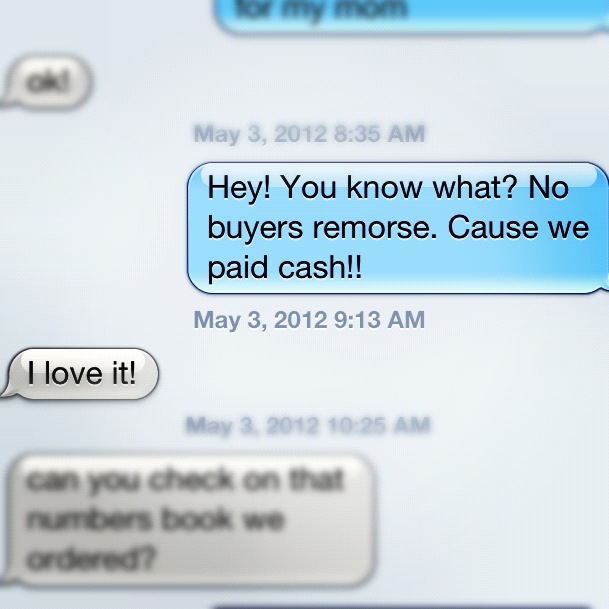

It was confirmed the day after the purchase when I texted Kelsey this message:

Buyer's remorse is a real thing. I had it ever since we bought our Jeep four years ago. Although it was a great vehicle and served us well, I always felt stupid for the way we went about purchasing it (with a loan), and the time I had to spend working two jobs just to pay it off. But it built some great character deep within me that urges me to never finance a vehicle again!

What's been your experience with vehicle purchases? Do you believe that you don't have to have car payments for the rest of your life?